Cheshire Fire Authority is launching a consultation on its precept (its share of council tax) for the forthcoming 2023/2024 financial year.

Cheshire Fire Authority is the publicly accountable body responsible for providing a fire and rescue service to the communities of Cheshire. The Authority has two main sources of income; grants from government (which make up around 33% of its budget) and through local council tax (which accounts for 67% of its budget). For the last financial year in 2022/23, the Authority had a total budget of £46.6m.

The Authority has a legal duty to set a balanced budget, which means matching its income with its outgoings. Its outgoings include paying staff wages, purchasing firefighting equipment, improving or maintaining premises and paying for things like energy and fuel.

In spite of the impact of austerity and the fact the Authority has not received capital funding (to pay for assets like fire stations) from the Government since 2014, it has in recent years been able to invest in its staff and its services through careful financial management and planning. This has allowed it to maintain equipment, invest in new technology, improve training and modernise its buildings. This has enabled Cheshire Fire and Rescue Service to become one of the most effective and efficient fire and rescue services in the country.

Unfortunately, the Authority is now facing further significant financial pressures, for example as a result of increases in the cost of energy and pay increases for staff (which are negotiated on a national basis and not always funded by the Government). Even after identifying a significant amount of savings, the Authority could be facing a funding gap of nearly £1m when it attempts to settle its 2023/24 budget; potentially more depending on the outcome of the pay dispute involving firefighters.

Fire and rescue authorities have been lobbying the Government in the hope that it will allow them to increase the amount that their council tax precept by more than has become the norm. In recent years increases have been limited to 2%. This level of increase in 2023/24 could mean that the Authority would struggle to maintain current levels of services in light of increases in costs.

The Government has now confirmed that it will allow authorities to increase their council tax precept by up to £5.00 per year for a Band D property. This would raise an additional £1.3m in funding compared to raising the precept by 1.99%, which would enable the Authority to maintain its current level of services and meet some of the pressures it faces from inflation and rising costs.

The impact of this increase on all council tax bands would be as follows:

- Band A - an increase of £3.33 per year, taking the annual precept from £54.99 to £58.32

- Band B - an increase of £3.89 per year, taking the annual precept from £64.15 to £68.04

- Band C - an increase of £4.44 per year, taking the annual precept from £73.32 to £77.76

- Band D - an increase of £5.00 per year, taking the annual precept from £82.48 to £87. 48

- Band E - an increase of £6.11 per year, taking the annual precept from £100.81 to £106.92

- Band F - an increase of £7.22 per year, taking the annual precept from £119.14 to £126.36

- Band G - an increase of £8.33 per year, taking the annual precept from £137.47 to £145.80

- Band H - an increase of £10.00 per year, taking the annual precept from £164.96 to £174.96

- The Fire Authority will consider its budget in February 2023 and at the meeting it will set its council tax precept. Before deciding what to do the Authority is keen to understand what people think. Please take a few moments to share your views on the Authority's proposal to increase its share of council tax.

- The survey, which is open until Monday 23 January 2023, can be accessed via the following link:

Household waste recycling centres – Advice for visiting during Easter period

Household waste recycling centres – Advice for visiting during Easter period

AstraZeneca workers toy drive to support Children’s Ward at Macclesfield Hospital

AstraZeneca workers toy drive to support Children’s Ward at Macclesfield Hospital

Council appoints new executive director of children’s services

Council appoints new executive director of children’s services

99% of Cheshire East parents secure preferred primary school place

99% of Cheshire East parents secure preferred primary school place

Young Northwich and Winsford to join globally inspired Carnival

Young Northwich and Winsford to join globally inspired Carnival

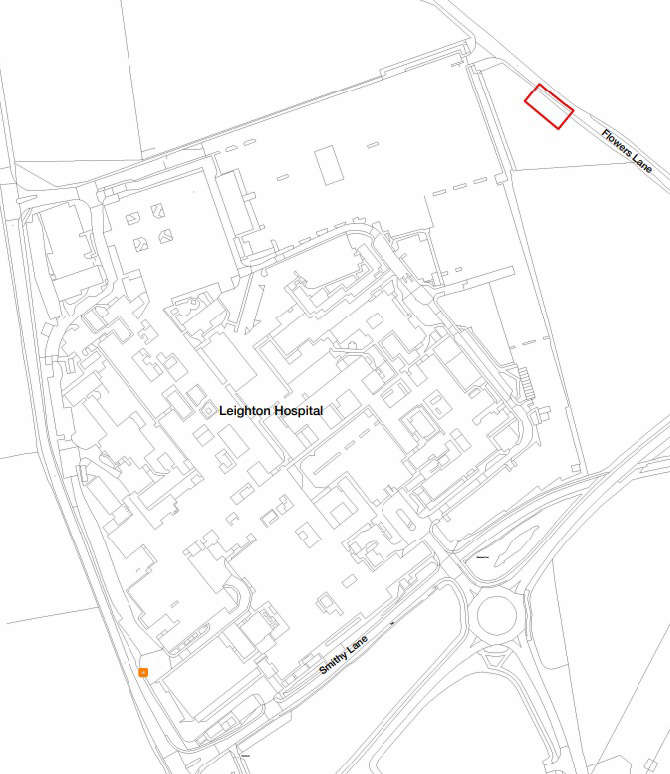

Government approves major funding for state-of-the-art Leighton Hospital facility

Government approves major funding for state-of-the-art Leighton Hospital facility

Teenager sentenced for stabbing another boy in Congleton

Teenager sentenced for stabbing another boy in Congleton

Appeal for witnesses and footage following collision in Alderley Edge

Appeal for witnesses and footage following collision in Alderley Edge

Man jailed for murder following stabbing in Northwich

Man jailed for murder following stabbing in Northwich

Bedside Bibles return to Macclesfield Hospital in time for Easter

Bedside Bibles return to Macclesfield Hospital in time for Easter

Cosmic Threads: 80 Years of Discovery

Cosmic Threads: 80 Years of Discovery

New stalls available at Macclesfield Market Hall

New stalls available at Macclesfield Market Hall

Council sets sights on major new trail to boost health, wellbeing and visitor economy

Council sets sights on major new trail to boost health, wellbeing and visitor economy

Knutsford Town Council renews partnership with The Royal Cheshire County Show

Knutsford Town Council renews partnership with The Royal Cheshire County Show

Major new trail to boost health, wellbeing and visitor economy

Major new trail to boost health, wellbeing and visitor economy

More than 60 premises targeted across Cheshire as part of NCA-coordinated crackdown

More than 60 premises targeted across Cheshire as part of NCA-coordinated crackdown

Appeal for witnesses and footage following collision on M6

Appeal for witnesses and footage following collision on M6

Laying the foundations for Mid Cheshire’s new hospital

Laying the foundations for Mid Cheshire’s new hospital

Police release CCTV following Macclesfield shop theft

Police release CCTV following Macclesfield shop theft

Comments

Add a comment